Average Price Of Living In Hawaii: Your Ultimate Guide To Paradise Living

Living in Hawaii may sound like a dream, but have you ever wondered about the average price of living in Hawaii? It’s not all sunshine and beaches; there’s a financial reality to consider. From housing costs to groceries, we’re diving deep into the nitty-gritty of what it takes to live in this tropical paradise. So buckle up, because we’re about to spill all the tea on Hawaii’s cost of living!

When people think of Hawaii, they picture palm trees, crystal-clear waters, and stunning sunsets. But there’s more to the islands than just postcard-perfect views. The average price of living in Hawaii is higher than most places in the U.S., and understanding the details is crucial if you’re considering making the move. Whether you’re planning a vacation or thinking of relocating, this guide will give you all the info you need to make an informed decision.

Let’s face it—living in paradise doesn’t come cheap. But don’t worry; we’ve got your back. In this article, we’ll break down the cost of living in Hawaii step by step, from rent and utilities to food and entertainment. By the end, you’ll have a clear picture of what to expect and how to budget accordingly. Ready? Let’s dive in!

Table of Contents

- Housing Costs in Hawaii

- Grocery Prices in Hawaii

- Transportation Expenses

- Utilities and Internet Bills

- Healthcare Costs

- Education Expenses

- Entertainment and Leisure

- Taxes in Hawaii

- Average Income in Hawaii

- Tips for Living Affordably in Hawaii

Housing Costs in Hawaii

First things first—let’s talk about housing. The average price of living in Hawaii starts with where you’ll lay your head at night. Real estate prices in Hawaii are among the highest in the nation, so finding affordable housing can be a challenge.

According to recent data, the median home price in Hawaii is around $800,000. That’s a big number, even for a dream home. If you’re not ready to buy, renting might be a better option, but it’s still pricey. A one-bedroom apartment in Honolulu, for example, can cost anywhere from $2,000 to $3,000 per month, depending on the location and amenities.

Here’s a quick breakdown:

- Median Home Price: $800,000

- Average Rent for a One-Bedroom Apartment: $2,500/month

- Average Rent for a Two-Bedroom Apartment: $3,500/month

Factors Affecting Housing Costs

Several factors influence housing prices in Hawaii, including the island’s limited land availability and high demand from tourists and retirees. Plus, the cost of building materials is higher due to the need for imports. So, if you’re planning to build your dream home, be prepared for a hefty price tag.

Grocery Prices in Hawaii

Now, let’s talk about food. Groceries in Hawaii are more expensive than on the mainland because most items are imported. This means that even basic staples like rice, bread, and milk can cost more than you’d expect.

Here’s a rough estimate of grocery prices in Hawaii:

- A gallon of milk: $5–$6

- A loaf of bread: $3–$4

- A dozen eggs: $4–$5

However, there are ways to save money on groceries. Shopping at local farmers’ markets or joining a community-supported agriculture (CSA) program can help you access fresh, affordable produce. Plus, you’ll be supporting local farmers while enjoying delicious island-grown fruits and veggies.

Meal Costs

Eating out in Hawaii can also be pricey, but it depends on where you go. A meal at a casual restaurant might cost around $15–$20 per person, while fine dining can easily exceed $50 per plate. If you’re on a budget, consider trying local eateries or food trucks for a more affordable dining experience.

Transportation Expenses

Getting around in Hawaii can be tricky, especially if you don’t have a car. Public transportation is available, but it’s limited compared to larger cities. If you plan to explore the islands, renting a car or buying one might be your best bet.

Here’s what you can expect to pay for transportation in Hawaii:

- Average Gas Price: $4–$5 per gallon

- Monthly Bus Pass: $60–$80

- Car Rental: $30–$50 per day

Tips for Saving on Transportation

To cut down on transportation costs, consider carpooling with coworkers or using ride-sharing apps like Uber or Lyft. Additionally, biking or walking can be great alternatives if you live close to your workplace or amenities.

Utilities and Internet Bills

Utilities in Hawaii are another significant expense to consider. Electricity rates are among the highest in the U.S., thanks to the state’s reliance on imported oil for power generation. However, many residents are switching to solar energy to reduce their utility bills.

Here’s a breakdown of average utility costs in Hawaii:

- Electricity: $300–$400 per month

- Water: $50–$70 per month

- Internet: $50–$70 per month

While these numbers might seem steep, there are ways to save. For instance, using energy-efficient appliances and LED lighting can help lower your electricity bill. Plus, bundling services like internet and cable can sometimes result in discounts.

Healthcare Costs

Healthcare in Hawaii is generally affordable compared to other states, thanks to the state’s Prepaid Health Care Act. This law requires employers to provide health insurance to employees who work 20 or more hours per week. However, if you’re self-employed or uninsured, healthcare costs can add up quickly.

Here’s what you might pay for healthcare in Hawaii:

- Monthly Insurance Premium: $300–$500

- Doctor’s Visit: $50–$100

- Prescription Medication: $10–$30

It’s essential to have health insurance in Hawaii, as medical emergencies can be costly. If you’re uninsured, look into programs like Medicaid or the Affordable Care Act to find affordable coverage options.

Education Expenses

Education is another important factor to consider when calculating the average price of living in Hawaii. The state has a robust public school system, and tuition for public universities is relatively affordable for residents. However, private schools and out-of-state tuition can be expensive.

Here’s a snapshot of education costs in Hawaii:

- Public K-12 Schools: Free

- Private School Tuition: $8,000–$15,000 per year

- University of Hawaii Tuition: $10,000–$20,000 per year (depending on residency status)

If you’re planning to send your kids to private school or attend college in Hawaii, be sure to factor these costs into your budget. Scholarships and financial aid can help ease the financial burden.

Entertainment and Leisure

Living in Hawaii offers endless opportunities for entertainment and leisure. From surfing and hiking to cultural festivals and concerts, there’s always something to do. However, some activities can be costly, especially if you’re a tourist.

Here’s a look at some common entertainment expenses:

- Surfing Lessons: $50–$100 per session

- Hiking Trails: Free (but park fees may apply)

- Movie Tickets: $10–$15 per person

Fortunately, many outdoor activities in Hawaii are free or low-cost. Exploring beaches, hiking trails, and parks can be a great way to enjoy the islands without breaking the bank.

Taxes in Hawaii

Taxes in Hawaii are another aspect to consider when calculating the average price of living. The state has a general excise tax (GET) of 4.166%, which applies to most goods and services. Additionally, there’s a transient accommodations tax (TAT) of 9.27% for short-term rentals.

Here’s a quick overview of taxes in Hawaii:

- General Excise Tax: 4.166%

- Transient Accommodations Tax: 9.27%

- Income Tax: 1.4%–11% (depending on income level)

While taxes in Hawaii may seem high, they help fund essential services like education, healthcare, and infrastructure. Plus, the state’s income tax rates are relatively low compared to other states.

Average Income in Hawaii

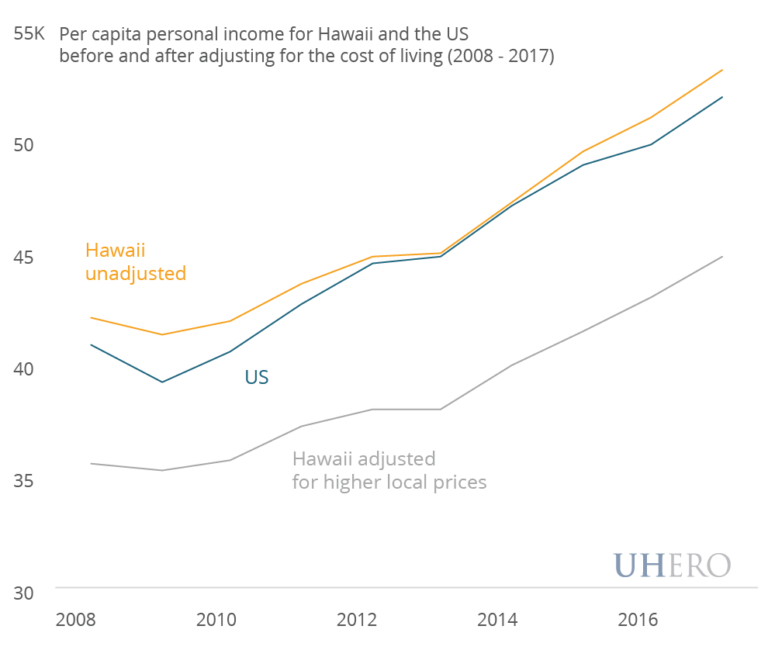

Now that we’ve covered expenses, let’s talk about income. The average household income in Hawaii is around $80,000 per year, which is higher than the national average. However, due to the high cost of living, this income may not stretch as far as it would in other states.

Here’s a breakdown of average salaries in Hawaii:

- Median Household Income: $80,000

- Average Teacher Salary: $60,000–$70,000

- Average Nurse Salary: $70,000–$90,000

It’s important to note that income levels can vary significantly depending on the industry and location. Jobs in tourism, healthcare, and education tend to pay well, but competition can be fierce.

Tips for Living Affordably in Hawaii

Living in Hawaii doesn’t have to break the bank if you’re smart about it. Here are some tips for living affordably in paradise:

- Shop at local farmers’ markets for fresh, affordable produce.

- Use public transportation or carpool to save on gas and parking.

- Take advantage of free or low-cost outdoor activities like hiking and beach visits.

- Consider renting a smaller apartment or sharing a home with roommates.

- Look for discounts and deals on entertainment and leisure activities.

By following these tips, you can enjoy all that Hawaii has to offer without sacrificing your financial well-being.

Final Thoughts

Living in Hawaii is a dream for many, but it comes with a price tag. The average price of living in Hawaii includes high housing costs, expensive groceries, and costly utilities. However, with careful budgeting and smart financial decisions, you can make it work. From finding affordable housing to enjoying free outdoor activities, there are plenty of ways to live comfortably in this tropical paradise.

So, if you’re considering a move to Hawaii, do your research and plan accordingly. And remember, while the cost of living may be high, the quality of life is priceless. Now go out there and make the most of your Hawaiian adventure!

Got any questions or tips for living in Hawaii? Drop a comment below and let’s chat! And don’t forget to share this article with your friends who might be dreaming of island life. Mahalo! 🌴

Young Troy Polamalu: The Legacy Of A Football Phenomenon

Carlos Santana Spouse: The Love Story Behind The Iconic Guitarist

Wentworth Miller: The Man Behind The Iconic Role In Prison Break

What's the Average Living Cost in Hawaii? Room Impact

Little relief from Hawaii’s high cost of living UHERO

Cost Of Living In Hawaii Living Expenses