What's The Net Worth? Unveiling The Secrets Behind Financial Success

Have you ever wondered what's the net worth of your favorite celebrities or successful entrepreneurs? Well, buckle up because we're diving deep into the world of finances, wealth, and how people manage to build their empires. From real estate to stocks, we’ll explore everything you need to know about net worth and why it matters. So, let's get started!

In today's fast-paced world, understanding financial health has become more important than ever. Whether you're a fan of keeping up with the Kardashians or a business enthusiast eager to learn about the wealthiest individuals on the planet, knowing what's the net worth is a crucial piece of information. It’s not just about numbers; it’s about the journey behind those figures.

But hold on, before we jump into the nitty-gritty details, let’s set the stage. Net worth isn’t just for the rich and famous. It’s a concept that applies to everyone, regardless of your income level or financial goals. By the end of this article, you’ll have a clearer picture of what net worth means, how to calculate it, and why it’s essential for your personal finance journey. Are you ready? Let's go!

Understanding the Basics: What's the Net Worth?

Alright, let’s break it down. So, what exactly is net worth? Simply put, your net worth is the difference between what you own (assets) and what you owe (liabilities). It’s like taking a financial snapshot of where you stand at any given moment. Think of it as your personal balance sheet. If your assets outweigh your liabilities, you’ve got a positive net worth. But if your debts are higher than your assets, well, you might want to rethink your financial strategy.

Here’s the cool part: net worth isn’t just about money in the bank. It includes everything from your home, car, investments, savings, and even that vintage guitar collecting dust in your attic. On the flip side, it also accounts for your mortgage, car loans, credit card debt, and any other financial obligations you might have. So, it’s a comprehensive look at your financial situation.

Why does it matter? Well, your net worth can be a powerful tool for measuring financial progress. It helps you set realistic goals, track your growth, and make informed decisions about your money. Whether you’re aiming for financial independence or just trying to pay off some debt, knowing your net worth is a great starting point.

Breaking Down the Net Worth Formula

Now that we’ve got the basics covered, let’s dive into the math. Calculating your net worth is pretty straightforward. Here’s the formula:

Net Worth = Assets – Liabilities

Let’s break it down further:

- Assets: These are everything you own that has monetary value. This includes cash, savings, retirement accounts, property, vehicles, investments, and even personal belongings like jewelry or art.

- Liabilities: These are your financial obligations or debts. Think mortgages, car loans, student loans, credit card balances, and any other outstanding payments.

For example, if your total assets are $500,000 and your total liabilities are $200,000, your net worth would be $300,000. Easy, right?

Why Knowing Your Net Worth is Important

Understanding your net worth goes beyond just knowing how much money you have. It’s about gaining insight into your financial health and making smarter decisions. Here are a few reasons why it matters:

- Financial Planning: Knowing your net worth helps you create a roadmap for achieving your financial goals, whether it’s buying a house, saving for retirement, or starting a business.

- Risk Management: A clear picture of your net worth allows you to assess risks and make adjustments to protect your assets.

- Debt Management: If your liabilities outweigh your assets, it’s a sign that you need to focus on reducing debt and building wealth.

- Legacy Building: For those looking to leave a financial legacy, understanding your net worth is key to planning for the future.

So, whether you’re just starting out or already well on your way to financial success, knowing your net worth is a game-changer.

What's the Net Worth of the Rich and Famous?

Let’s face it, we all love a good celebrity net worth story. From tech moguls to Hollywood stars, the wealth of these individuals is often the stuff of legends. But how do they accumulate such massive fortunes? And what can we learn from their journeys?

Biography: The Road to Wealth

Take a look at some of the most successful people in the world and you’ll notice a common thread: hard work, perseverance, and a bit of luck. Here’s a quick rundown of a few notable figures:

| Name | Net Worth | Source of Wealth |

|---|---|---|

| Elon Musk | $250 billion (as of 2023) | Tesla, SpaceX, Neuralink |

| Jeff Bezos | $120 billion (as of 2023) | Amazon |

| Kim Kardashian | $1 billion (as of 2023) | SKIMS, KKW Beauty, Reality TV |

| Leonardo DiCaprio | $260 million (as of 2023) | Acting, Environmental Activism |

As you can see, each of these individuals has taken a unique path to success. Some started with groundbreaking ideas, while others leveraged their fame to build empires. But one thing is clear: they all prioritized building wealth over short-term gains.

How to Increase Your Net Worth

So, how do you go from where you are now to becoming the next billionaire? It’s all about making smart financial decisions. Here are a few strategies to boost your net worth:

Invest in Assets That Appreciate

One of the best ways to grow your net worth is by investing in assets that increase in value over time. This could include real estate, stocks, or even collectibles. The key is to do your research and invest wisely.

Pay Down Debt

High-interest debt can be a major drag on your net worth. Prioritize paying off credit card balances, student loans, and other debts to free up more money for saving and investing.

Build Multiple Streams of Income

Don’t put all your eggs in one basket. Diversify your income sources by starting a side hustle, investing in rental properties, or launching a business. The more streams of income you have, the faster your net worth can grow.

Common Misconceptions About Net Worth

There are a lot of myths and misconceptions floating around about net worth. Let’s clear some of them up:

- Net Worth Equals Happiness: While having a high net worth can provide financial security, it doesn’t guarantee happiness. True fulfillment comes from a balanced life, not just money.

- Only the Rich Have Net Worth: Everyone has a net worth, even if it’s negative. The key is to focus on improving it over time.

- Net Worth is Static: Your net worth can fluctuate based on market conditions, changes in income, and shifts in liabilities. It’s important to regularly reassess and adjust your financial strategy.

Net Worth and Financial Independence

For many people, achieving financial independence is the ultimate goal. This means having enough wealth to cover your living expenses without relying on a traditional job. Your net worth plays a critical role in reaching this milestone.

Here’s how it works: by building a solid net worth, you can generate passive income through investments, rental properties, and other assets. This income can then cover your daily expenses, allowing you to live life on your terms. It’s not just about the money; it’s about the freedom it provides.

Tools and Resources for Tracking Net Worth

In today’s digital age, there are plenty of tools and resources available to help you track your net worth. From apps to spreadsheets, here are a few options to consider:

Popular Apps

- Mint: A free app that helps you manage your budget, track expenses, and monitor your net worth.

- Personal Capital: A comprehensive tool for tracking investments, retirement accounts, and overall net worth.

- You Need a Budget (YNAB): A budgeting app that emphasizes living within your means and building wealth over time.

DIY Spreadsheets

If you prefer a more hands-on approach, creating a spreadsheet to track your assets and liabilities can be a great option. Excel and Google Sheets are both powerful tools for managing your finances.

Conclusion: Take Control of Your Financial Future

So, there you have it. What's the net worth? It’s more than just a number; it’s a reflection of your financial health and a tool for achieving your dreams. Whether you’re aiming for financial independence or just trying to pay off some debt, understanding your net worth is a crucial step in the right direction.

Now, it’s your turn. Take action by calculating your net worth, setting financial goals, and making smart decisions about your money. And don’t forget to share this article with your friends and family. Together, we can all work towards a brighter financial future. So, what’s stopping you? Get started today!

Table of Contents

- Understanding the Basics: What's the Net Worth?

- Breaking Down the Net Worth Formula

- Why Knowing Your Net Worth is Important

- What's the Net Worth of the Rich and Famous?

- How to Increase Your Net Worth

- Common Misconceptions About Net Worth

- Net Worth and Financial Independence

- Tools and Resources for Tracking Net Worth

- Conclusion: Take Control of Your Financial Future

Erica Mena Net Worth: A Deep Dive Into Her Financial Empire And Success Story

Warren Beatty Bio: A Legendary Journey Through Hollywood's Golden Era

Vanilla Ice Net Worth 2023: A Deep Dive Into His Financial Empire

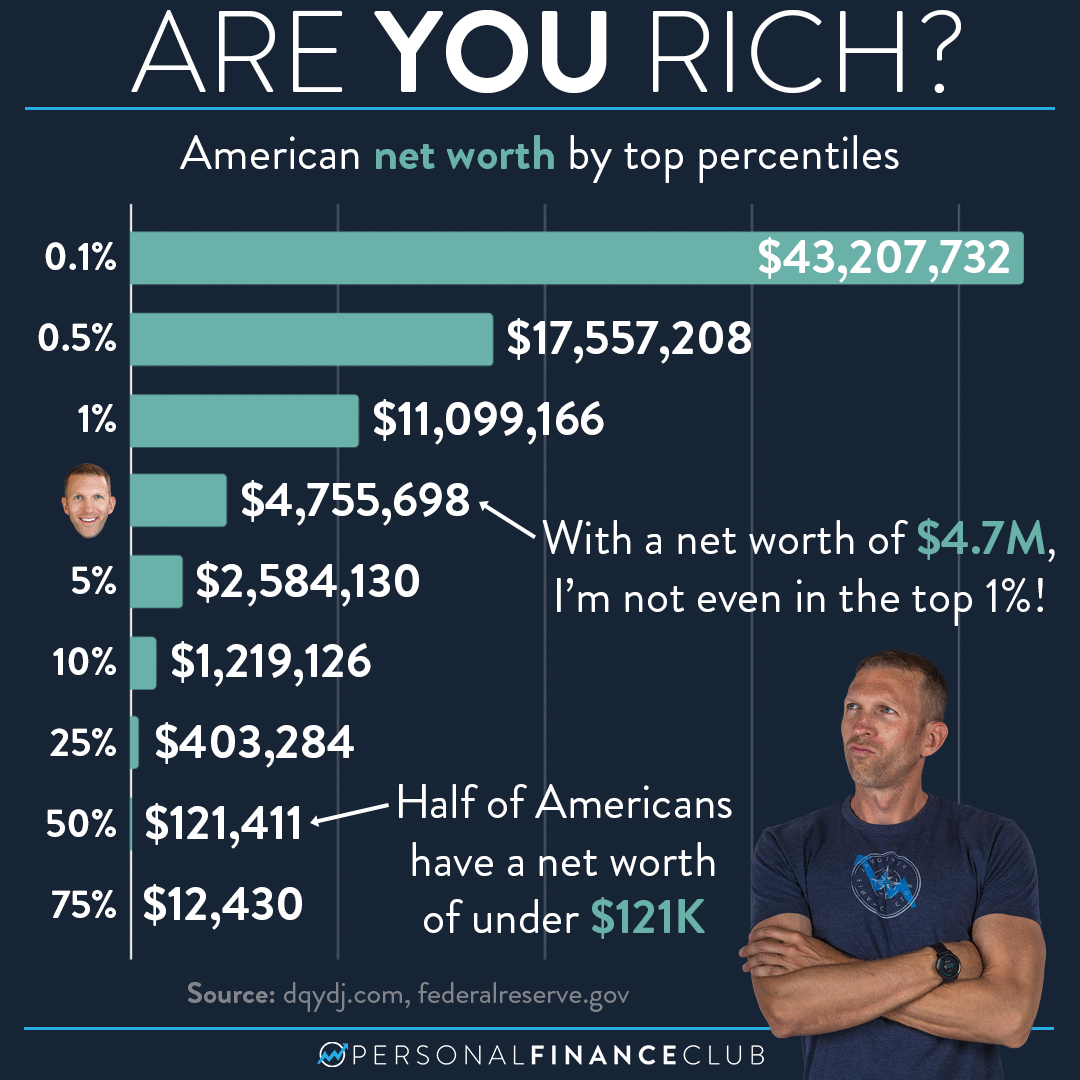

US Net Worth By Top Percentiles Breakdown Personal Finance Club

T.I.’s Net Worth (Updated 2023) Inspirationfeed

Ti Net Worth Wealth And